Newsletter

Income Recognition and Calculation under Taiwan CFC Rules – Individuals

Anti-tax avoidance has become an international enforcement trends and many countries have been implementing rules on transfer pricing and Controlled Foreign Corporations ("CFC") to make low-tax countries or regions lose their functions as tax havens. Furthermore, the implementation of the Global Minimum Tax (GMT) is also approaching, and so using low tax as an incentive to attract investment may not be useful in the future. Taiwan will also implement its CFC rules in 2023, and except for cases under certain exemptions, individuals who directly or indirectly hold 50% or more of the shares or capital of an affiliate in a low-tax country or region outside of Taiwan or have significant influence over such affiliate, and together with his/her spouse and relatives within the second degree of kinship directly hold 10% or more of the shares or capital of the CFC should, when filing their 2023 individual income tax returns in May 2024, calculate the overseas proceeds based on their shareholding percentage of CFCs and include such proceeds into their taxable income (overseas income) under the Income Basic Tax Act (the "Alternative Minimum Tax Act" or the "AMT Act").

The Ministry of Finance (the "MOF") has announced that the Taiwan CFC Rules and the "Regulations Governing Application of Income Calculations from Controlled Foreign Company for Individuals" (the "Individual CFC Regulations" or the "Regulations") will take effect in 2023. Furthermore, the MOF provides certain examples for the income recognition and calculation under the Regulations (see below). This article is a brief introduction for your reference.

Assessable CFC Operating Income

When a CFC receives distribution by its portfolio company, even if such proceeds have not been actually distributed to its individual shareholders, where the following criteria are satisfied, they should still be included in the current year's overseas proceeds of the individual shareholders for the purpose of calculating their taxable income; then, when the CFC actually distribute dividends or earnings, the amount thereof already been counted towards an individual shareholder's overseas proceeds in prior years will not be counted again as a part of his/her taxable income:

1. The individual and its related parties directly or indirectly hold at least 50% of the shares or capital of the CFC, which is located in a low-tax country or region outside of Taiwan, or have significant influence over the CFC;

2. The individual or his/her spouse and relatives within the second degree of kinship together directly hold 10% or more of the shares or capital of the CFC as of December 31 of the current year;

3. The CFC does not engage in substantial business activities at the place of its incorporation unless its current year earnings is less than NT$7 million.

Calculation of CFC's Current Year Earnings

According to the Regulations, the calculation of a CFC's current year earnings is based on its current year's net income after tax calculated under Taiwan's GAAP. However, considering that its portfolio company located in a non-low-tax country or region may need to retain earnings as working capital or to meet its investment needs and not for tax avoidance purposes, its investment proceeds from portfolio companies in non-low-tax countries or regions recognized under the equity method are recognized as the CFC's current year earnings based on the actual distribution (realized loss), and, if not distributed to the CFC, are not required to be included in the CFC's current year earnings. The calculation formula is as follow:

Earnings for the year = CFC's net income for the year calculated in accordance with Taiwan GAAP, the amount transferred from other comprehensive income or loss and other equity items to undistributed earnings for the year, less item 1 and plus item 2 below.

1. (The portfolio company's investment proceeds in non-low-tax countries or regions recognized under the equity method - the portfolio company's investment loss in non-low-tax countries or regions recognized under the equity method)

2. [(the board-approved distribution from its portfolio company's earnings in non-low-tax countries or regions recognized under the equity method) x the percentage of the CFC's ownership of the portfolio company at the date of the distribution - realized investment loss of the portfolio company recognized under the equity method × the percentage of the CFC's ownership of the portfolio company on the date of realization)].

The realized amount of the approved earnings distribution or investment loss of the portfolio company in a non-tax country or region should be recognized based on the amount agreed by the shareholders of the portfolio company or approved at the shareholders' meeting, and the year in which the distribution or realization date occurs is the year of accrual.

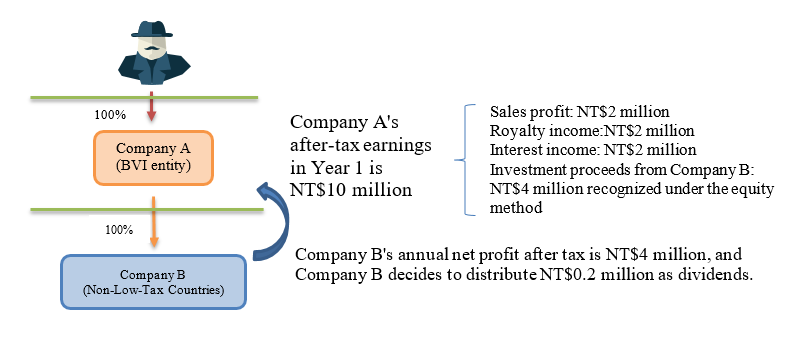

For instance, assuming Company A is the CFC of Mr. X, a Taiwan national, Mr. X holds 100% of Company A, Company A holds 100% of Company B, which is located in a non-low-tax country/region, and Company A's after-tax earnings in Year 1 are NT$10 million (NT$2 million in sales profit, NT$2 million in royalty income, and NT$2 million in interest income, and NT$4 million in investment proceeds from Company B recognized under the equity method; also, Company B decided to distribute NT$200,000 as dividends). Question: What are the current year earnings of the CFC (i.e., Company A)?

Company A's Year 1 earnings

= Company A's after-tax earnings of NT$10 million - Company B's investment proceeds recognized under the equity method of NT$4 million + Company B's approved dividends distribution of NT$0.2 million = NT$6.2 million

Calculation Method of CFC Revenues that should be Counted as an Individual's Taxable Income

In accordance with Article 6(1) of the Regulations, an individual shall include into his/her taxable income the current year earnings of a CFC, less any legal reserve or non-distributable amount under the laws of the country or region in which the CFC is located and any losses in the prior years as assessed by the tax authority, in proportion to the shares or capital of the CFC held directly thereby and the period of ownership.

Calculation Method of CFC Revenues that should be Counted as an Individual's Taxable Income = (CFC's current year earnings - legal reserve or non-distributable amount under the laws of the CFC's country or region - assessed losses in prior years) × direct holding percentage × holding period

A corresponding portion of a CFC earnings should be included in its individual shareholder's taxable income of that year together with his/her overseas proceeds as stipulated in the AMT Act, except for single tax-payers with an annual total of less than NT$1 million.

For instance, assuming Company A is located in a low-tax country or region, Taiwan national Mr. X acquires 60% of Company A on April 1, Year 1, and Company A is the CFC of Mr. X. Company A's earnings for the year are NT$2 million, and Company A is required to have a legal reserve of NT$200,000 in accordance with the laws of the country/region in which it is located.

Company A's earnings that should be counted as Mr. X's taxable income = (CFC's current year's earnings of NT$2 million - NT$200,000 of legal reserve or non-distributable amount under the laws of the country/region where the CFC is located – NT$0 of the assessed loss for prior years) × direct holding percentage of 60% × holding period (275/365) = NT$813,700.

If Mr. X, as a single tax-payer, only has the CFC earnings described above, it is exempt from being included into his taxable income (overseas income) because the total amount for the year does not reach NT$1 million.

Filing Method

The financial statements of the CFC should be prepared in accordance with Taiwan GAAP and certified by a qualified accountant in the country or region where the CFC is located or in Taiwan.

However, if there is other documentary evidence to prove the authenticity of CFC's financial statements and it is confirmed by the tax authority of the individual's domicile, such documentary evidence may replace the CPA-certified financial statements.

Avoiding Double Taxation

In accordance with Article 7(1) of the Regulations, the portion of the CFC's dividends or earnings that have been counted as overseas proceeds and included as a part of the taxable income should be excluded from the taxable income for the year in which they are distributed, while the remaining amount should be included into the taxable income for the year in which they are distributed.

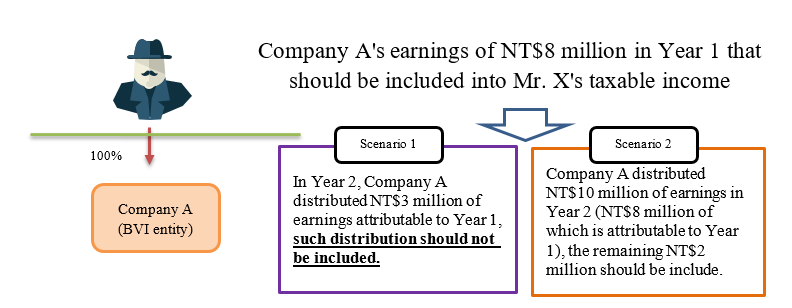

For instance, assuming Mr. X owns 100% of Company A which is Mr. X's CFC, in Year 1, Mr. X should identify the relevant part of Company A's overseas proceeds of NT$8 million pursuant to Article 6(1) of the Regulations and include it into its taxable income for the year in accordance with Article 12(1) of the AMT Act.

Scenario 1

In Year 2, Company A distributed NT$3 million of earnings attributable to Year 1, since Mr. X had already been taxed under the CFC rules for individual in Year 1, the NT$3 million of earnings distributed by Company A was not counted as part of Mr. X's taxable income in the year of distribution (i.e., Year 2).

Scenario 2

If Company A distributes earnings of $10 million in Year 2 (of which NT$8 million is attributable to in Year 1), the NT$8 million should not be counted repeatedly in Mr. X's taxable income for the year in which it is distributed and the remaining NT$2 million should still be included in Mr. X's taxable income for Year 2.

Tax Refunds and Deductions

Regarding the dividends or earnings actually distributed by a CFC to its individual shareholders, in accordance with Article 7(2) and Article 8(1)(5) of the Regulations, an individual who has paid income tax thereon in accordance with the tax laws of the country or region where the CFC is located, within five years from the day following the expiration of the filing period for the year in which such distribution is included into the individual's taxable income, may present a tax certificate issued by the tax authorities of the country/region where the CFC is located and claim a tax credit against its taxable income for each year in which such distribution is included into the individual's taxable income.

In accordance with Article 7(2) of the Regulations, the above-mentioned credits or refunds shall not exceed the individual's increased taxable income as a result of including therein the amount calculated under the CFC rules.

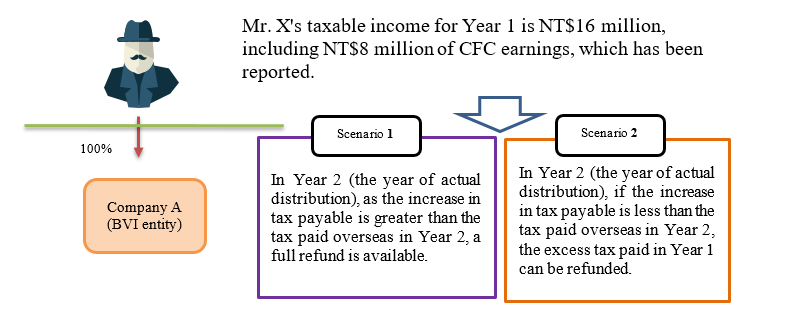

For instance, assuming that Mr. X holds 100% of the shares of Company A, Company A is the CFC of Mr. X. In Year 1, Mr. X should identify the relevant part of Company A's earnings of NT$8 million pursuant to Article 12-1 of the AMT Act and include it into its taxable income for the year. In Year 2, Company A paid NT$8 million in taxes and presented a tax certificate issued by the local tax authority.

Scenario 1

Assuming that, in Year 1, Mr. X has NT$ of comprehensive net income and NT$16 million of taxable income (including NT$8 million of overseas earnings from Company A), the amount of Mr. X's taxable income and deductible limit are calculated as follows:

1. Mr. X's taxable income in Year 1 = (NT$16 million - NT$6.7 million) × 20% = NT$1.86 million

2. Mr. X was distributed NT$8 million of dividends in Year 2 but he has already paid income tax thereon in Year 1, so he applies for a correction credit and recalculates the creditable amount of Mr. X's overseas tax paid in Year 1 = (taxable income of NT$1.86 million - consolidated income tax payable of NT$0) × [overseas proceeds of NT$8 million / (taxable income NT$16 million - consolidated net income of NT$0)] = NT$930,000 (as it is greater than NT$0.8 million of tax paid overseas for overseas proceeds in Year 2, the deductible limit is NT$0.8 million)

3. Year 1 taxable income of NT$1.86 million - deductible limit of NT$0.8 million = taxable income of NT$1.06 million; Mr. X can claim a refund of NT$0.8 million as the overage paid in Year 1.

Scenario 2

Assuming that Mr. X has no other taxable income in Year 1 other than Company A's overseas proceeds of NT$8 million, his taxable income and deductible limit are calculated as follows:

1. Mr. X's taxable income in Year 1 = (NT$8.0 million - NT$6.7 million) × 20% = NT$260,000

2. Mr. X was distributed NT$8 million of dividends in Year 2 but he has already paid income tax thereon in Year 1, so he applies for a correction credit and the tax authority recalculated the deductible amount of Mr. X's tax paid overseas in Year 1.

= (Taxable income of NT$260,000 - consolidated income tax payable of NT$0) × [Overseas proceeds of NT$8 million / (Taxable income of NT$8 million - consolidated net income of NT$0)] = NT$260,000 (less than the NT$800,000 paid for overseas proceeds overseas in Year 2)

3. Year 1 taxable income of NT$260,000 - deductible limit of NT$260,000 = taxable income should be NT$0.

Mr. X can claim a refund of the Year 1 tax overpayment of NT$260,000.

Trade of CFC Shares or Capital

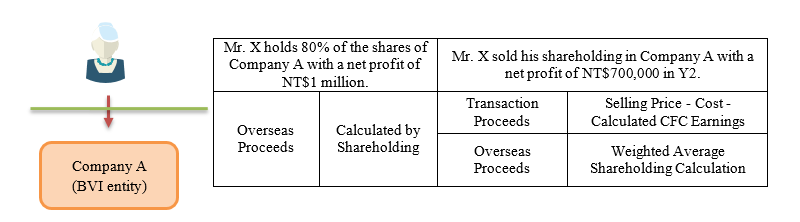

Finally, when an individual trades CFC shares or capital stock, in accordance with Article 7 (3) of the Regulations, the profit or loss on the transaction is calculated as follows:

1. Transaction gain or loss = Transaction revenue - original acquisition cost - (the balance of the CFC earnings calculated on the transaction date × transaction percentage)

2. The balance of the CFC income calculated as of the previous transaction date = the accumulated CFC income calculated as of the transaction date - the amount of dividends or earnings actually distributed in each previous transaction that is not included in the year of distribution - the amount of the balance of the CFC income calculated as of the previous transaction rate less the amount of the CFC income.

For instance, Mr. Y holds 80% of Company A's shares (1,000 shares at NT$1,000 per share), Company A is Mr. Y's CFC, Company A's Year 1 earnings are NT$1 million; Mr. Y sold one hundred shares on July 1 of Year 2 at NT$5,000 per share, Company A's Year 2 earnings are NT$700,000. Mr. Y's overseas proceeds of Year 1 and Year 2 and the gain or loss from the transactions are calculated as follows:

1. Transaction income that should be included into Mr. Y's Year 1 overseas proceeds = NT$1 million x 80% = NT$0.8 million, which should be included into Mr. Y's overseas proceeds.

2. Year 2 transaction gain or loss = transaction revenue - original acquisition cost - the balance of the calculated CFC profit on the transaction date × transaction percentage

Year 2 transaction gain or loss = (NT$5,000 x 100 shares) - (NT$1,000 x 100 shares) - NT$800,000 x (100/1,000) = NT$320,000

3. Year 2 overseas proceeds = NT$700,000 × [(80% × 6/12) + (72% × 6/12)] = NT$532,000

(Note) Mr. Y originally held 1,000 shares of Company A (80% of all 1,250 shares of Company A), and after the sale of one hundred shares on July 1 in Year 2 , Mr. Y's shareholding percentage was 72% (900/1,250) from that date onwards.

Conclusion

Taiwan CFC rules and the Regulations will take effect in 2023. While the MOF has made many public announcement and explanations, there are still many details or issues about the implementation of the CFC rules that need to be clarified, especially those regarding the reporting of the individual CFCs. When a family enterprise faces the CFC issues, there are many details that will might be overlooked, including whether the disclosure of the offshore investment structure and the financial statements of the offshore company will give rise to tax risks on past overseas proceeds or even estate and gift taxes, whether the family members' positions are consistent when reporting CFC income, and whether any restructuring before the CFC rules takes effect will give rise to tax risks in Taiwan or other regions. On the issue of tax, as each person's situation is different, it is not possible to apply one tax structure or method to all. Therefore, the best way to address these concerns is to consult a professional to obtain the necessary assistance and advice. Our tax team is composed of tax lawyers and certified public accountants licensed in Taiwan and overseas who are familiar with the latest changes in domestic and international tax laws, and we work closely with L&L, Leaven & Co., CPAs and have an in-depth knowledge of taxation practices in Taiwan. If you have any questions about the CFC Rules, please do not hesitate to contact our Tax Practice Group.