Newsletter

Summary of the Draft Amendments to the Enforcement Rules of the Labor Standards Act

Following the enactment of the latest amendments to the Labor Standards Act (the "LSA") on December 21, 2016, the Ministry of Labor published the Draft Amendments to the Enforcement Rules of the Labor Standards Act (the "Draft") on March 13 of 2017 in order to gather feedback from the public before finalizing the Draft. While some adjustments might still be made, the Draft is expected to remain more or less the same and take effect in May or later this year. A summary of the Draft is as follows:

I. Article 2

The average wage, which is the basis for calculating an employee's severance pay, pension, compensation for occupational hazard, and compensation for non-competition obligation following termination, shall be calculated based on the employee's wage for the six-month period immediately before the event that requires such computation. Such calculation is to ensure that the interests of an employee that are based on his/her average wage will not be impacted by any extraordinary circumstances during his/her employment. According to the Draft, the wage and the number of days during the following seven periods shall not be included when calculating average wage (Items (5), (6) and (7) below are additions to the Enforcement Rules of the LSA):

The average wage, which is the basis for calculating an employee's severance pay, pension, compensation for occupational hazard, and compensation for non-competition obligation following termination, shall be calculated based on the employee's wage for the six-month period immediately before the event that requires such computation. Such calculation is to ensure that the interests of an employee that are based on his/her average wage will not be impacted by any extraordinary circumstances during his/her employment. According to the Draft, the wage and the number of days during the following seven periods shall not be included when calculating average wage (Items (5), (6) and (7) below are additions to the Enforcement Rules of the LSA):

(1) The day of occurrence of the event that requires the computation of an employee's average wage;

(2) The period of an employee’s medical treatment for an occupational injury;

(3) The period during which an employee's wages were paid at one-half of the normal rate as set forth in Paragraph 2, Article 50 of the LSA;

(4) The period during which an employee was unable to work due to his/her employer's suspension of business caused by a natural disaster, accident or other force majeure event;

(5) The period during which an employee was on sick leave, and such leave was taken in accordance with his/her employer's leave-taking rules;

(6) The period during which an employee was receiving lower-than-normal wages due to menstrual leave, maternity leave, family care leave or pregnancy leave, and such leave was taken in accordance with the LSA and the Act of Gender Equality in Employment; and

(7) The period of leave without pay.

II. Article 7

In response to the newly added rest days under Article 36 of the LSA, a mandatory provision which specifies that employees are entitled to one rest day in every seven days must be included in all employment contracts. The day of the rest days shall be agreed upon by the employer and the employee. For employers that adopt normal work weeks, Saturdays are usually the designated rest days.

III. Article 11

Minimum wage is the compensation an employee receives for his/her work within normal working hours. Since the addition of rest days under the LSA, work carried out on a rest day is considered overtime work for which the wage received by the employee shall not be included as part of the minimum wage.

IV. Article 14

The existing rules stipulate that the minimum wage for underage workers shall not be lower than 70% of the normal minimum wage. However, in order to protect the rights of underage workers, such rules have been deleted in the Draft and underage workers will be able to enjoy the normal minimum wage protection.

V. Article 14-1

The LSA specifies that employers shall provide employees with detailed statements showing the calculation of their wages and that employers shall keep complete records of wages and employment. The Draft stipulates that the following items shall be included in such detailed statements:

(1) The total amount of wages agreed upon by the employer and the employee;

(2) The amount of payment in each category of the wage payment including the base salary, bonus, benefit, overtime pay and other compensation for the employee's work;

(3) Deductions required by law or otherwise agreed upon by the employer and the employee including labor insurance and health insurance premiums borne by the employee, the employee’s pension contribution and welfare fund contribution;

(4) The actual amount of payment received by the employee.

The Draft also requires that such detailed statements be readily available to employees in written and electronic forms (e.g. e-mail, text message, messaging app, the employer's internal payroll system).

VI. Article 20

In response to the newly added rest days under Article 36 of the LSA, the Draft requires that an employer to make a public announcement if it decides to adopt a flexible working hour system or change the day of rest days.

VII. Article 20-1

In response to the newly added rest days under Article 36 of the LSA, the Draft stipulates that all work carried out on rest days shall be deemed as overtime work.

VIII. Article 21

According to Paragraph 5, Article 30 of the LSA, employers shall prepare employees' attendance records. The Draft further provides that such attendance records shall include attendance logs, clock card machines, clock cards, access cards, records on biometric identification systems (e.g. fingerprint sensors), electronic attendance records or other records that can verify and record employees' time of attendance.

The Draft also requires employers to present the above-mentioned records in a written form if the authority conducts a labor inspection or if an employee requests for a review of the records.

IX. Article 23

The Draft specifies that national holidays (including memorial days and other holidays), on which employees are entitled to have a day off, shall be those announced by the Ministry of the Interior. The number of national holidays has been reduced from 19 to 12 days per year.

X. Article 23-1

The Draft specifies that if a national holiday (except for a day-off otherwise designated by the competent authority such as an election day) falls on a fixed day-off or a rest day, the fixed day-off or rest day shall be deferred to a date mutually agreed upon by the employer and the employee.

XI. Article 24

The Draft states that the cycle for calculating an employee's annual leave shall commence on the first day of his/her employment; employers shall grant employees annual leaves in accordance with Paragraph 1, Article 38 of the LSA. In other words, except for employees whose period of service is between six months and one year, the cycle for calculating employees’ annual leave shall start from the first day of his/her employment.

In order to provide some flexibility, the Draft specifies that employers and employees may negotiate and agree to adopt one of the following three cycles for calculating annual leaves:

(1) By the anniversary date: The annual cycle starts on the first day of the employee's employment. However, for an employee whose period of service is between six months and one year, he/she is entitled to take annual leave at the start of the six months' service period.

(2) By the calendar year: The annual cycle starts on January 1 and ends on December 31 of each year.

(3) By the fiscal year: The annual cycle is consistent with the employer’s fiscal year.

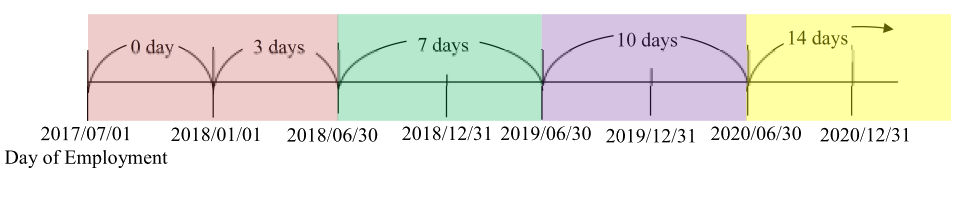

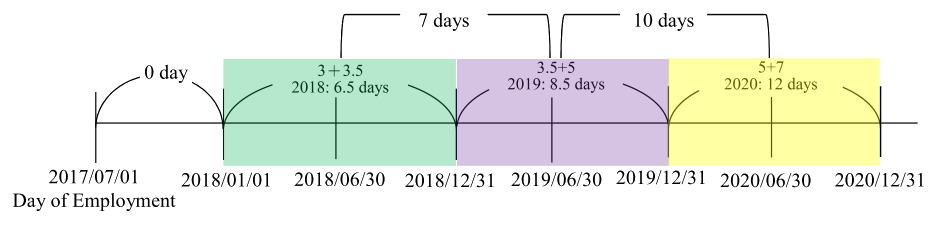

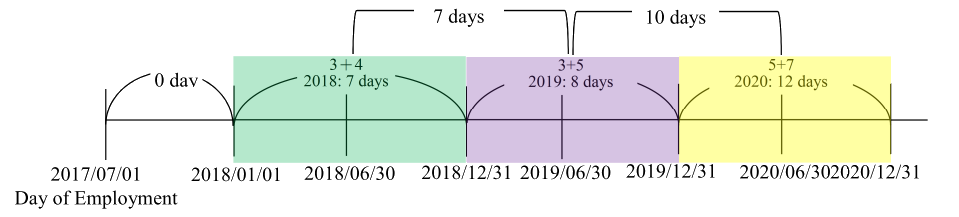

The following charts illustrate how annual leaves are granted based on an employee's years of service and the first two cycles above:

By anniversary date:

By calendar year (Example 1)

By calendar year (Example 2)

According to Paragraph 3, Article 38 of the LSA, employers shall notify employees of their annual leave entitlements within 30 days following the day on which the employees become eligible to take such leave.

XII. Article 24-1

(1) Employees shall receive a lump sum payment for their unused annual leave at the end of a year. The Draft stipulates that "at the end of the year" shall mean the end of the employment’s anniversary date, calendar year, or fiscal year cycle, whichever has been adopted by the employer.

(2) Unused annual leave payment shall be calculated and paid in accordance with the following rules as set forth under the Draft:

1. Payment calculation:

i.Employees shall receive 100% of their daily wage for every day of unused annual leave. For example, if an employee has five days of unused annual leave as of the end of a year, the employer shall pay such employee five days of daily wage.

ii.The wage referred to in the preceding paragraph shall mean an employee's daily wage immediately before the end of the annual leave calculation cycle or before the termination of employment contract. If an employee's wage is calculated on a monthly basis, for the calculation hereunder, the employee's monthly wage right before the end of the annual leave calculation cycle or the termination of the employment shall be divided by 30, and the result shall be deemed the daily wage.

2. Deadline for making unused annual leave payment

(1) At the end of the year: Unused annual leave payment shall be made on the regular pay day or within 30 days following the end of the annual calculation cycle. For example, if the regular pay day is the 5th day of every month, and that the end of the annual calculation cycle is April 15, the unused annual leave payment shall be made on May 5 or before May 15 of the same year at the latest.

(2) Upon termination of employment contract: Unused annual leave payment shall be made on the date of termination or the regular pay day. For example, if the regular pay day is the 5th day of every month, and that the employment contract is terminated on April 15, the unused annual leave payment shall be made on April 15 or before May 5 of the same year at the latest.

XIII. Article 24-2

Employers shall give yearly and regular notifications to their employees regarding their annual leave entitlements (number of days) and amount of unused annual leave payment. The Draft provides that such notifications shall be given in writing in accordance with the following rules:

(1) A written notice shall be given before the applicable payment deadline specified under Article 24-1; and

(2) A written notice shall be made readily available and printable for employees in written or electronic forms.

XIV. Article 24-3

Article 39 of the LSA specifies that with the consent of an employee, the employer may ask the employee to work on a paid day-off, provided that the employer pays such employee double his/her pay for such work. The Draft stipulates that a paid day-off refers to a national holiday or memorial day set forth under Article 37 of the LSA or a day of annual leave specified under Article 38 of the LSA. In other words, double pay for working on a paid day-off only applies to work carried out on a national holiday, memorial day or a day of annual leave.